The Importance of Gold and How You Can Invest in It for Your Future

Gold has always been one of the most treasured commodities globally. Whether it’s for an individual or a nation, gold plays a crucial role in ensuring financial security and stability. On a national level, gold reserves are used to stabilize currency values, reduce economic risks, and hedge against inflation. For individuals, gold is often a symbol of wealth, tradition, and security. In countries like India, where gold has deep cultural significance, it is not only a form of investment but also a way to secure a future.

India ranks as the fifth-largest importer of gold in the world (2023), reflecting the country's strong cultural attachment to gold. Its high liquidity and ability to be easily converted to cash make gold an attractive option for people looking to safeguard their savings. With increasing economic uncertainties, many are turning to gold as a safe asset to protect their wealth.

How to Save and Invest in Gold: Different Options Available

ThangaMayil DigiGold Savings App: A Smart Way to Save Gold

- DIGIGOLD

- SUPERGOLD

- THANGAMAGAL

- FUTUREPLUS

Details of the DigiGold Scheme:

- Minimum Investment: You can start with as little as INR 100 per day.

- Flexible Investments: There are no restrictions on how many times you can invest in a day.

- Scheme Duration: The scheme lasts for one year, with the option to redeem gold within 35 days after the scheme’s conclusion( from the 330th day).

- App Accessibility: The DigiGold Scheme can be easily accessed through the ThangaMayil DigiGold app, available on both PlayStore and AppStore

Advantages of the DigiGold Scheme:

- Investment Flexibility: The scheme allows daily investments starting at INR 100. This flexibility enables you to invest according to your budget and convenience.

- Buy Gold at Market Rates: For every purchase you make, the equivalent weight of 22KT gold is credited to your account at the prevailing market price on that day.

- Additional Benefits:

- 5% benefit for investments made in the first 75 days.

- 3.75% benefit for investments made between 76-150 days.

- 2% benefit for investments between 151-225 days.

- 0.75% benefit for investments made between 226-300 days.

- No Fixed Payments: There is no set amount you need to contribute. You can invest as much or as little as you want, whenever you want.

- Gold Redemption: You can redeem your accumulated gold as ornaments, gold coins or even silver depending on your preference. For silver, the weight of the accumulated gold will be converted into its equivalent value based on the redemption day's rate and the amount of silver can be then purchased according to the current silver rate.

- Multiple Payment Options: Payments for gold purchases can be made via UPI apps like Google Pay, PhonePe, BHIM, and e-wallets like Amazon Pay, Mobikwik, etc.

- Averaging Gold Prices: By making regular investments, you can average out the price of gold, reducing the impact of price fluctuations in the future.

Disadvantages of the DigiGold Scheme:

While the DigiGold scheme offers numerous benefits, there are a few points to consider:

- Lock-In Period: There is a 30-day lock-in period from the start date of the scheme, during which you cannot redeem your savings.

- GST and Charges: Additional charges, such as GST, hallmark, VAT (for wastage and making charges), apply during redemption.

- No Benefits After 300 Days: For investments made on the 301st to 330th day, no additional benefits are added.

- No Refunds: If you choose to exit the scheme early, there is no refund. You must redeem your gold before you can exit.

- Not Ideal for Investment in Ornaments: Redeeming your savings as ornaments may not be the best choice for investment purposes, as you will have to pay additional charges for making, wastage, and GST.

How to Join the DigiGold Scheme?

- Aadhaar Card

- PAN Card

- Valid Mobile Number and Email Address

- Address Proof (as per your ID)

Once registered, you can start investing immediately, and the app will help you track your investments and accumulated gold.

How Safe Is the ThangaMayil DigiGold App?

The ThangaMayil DigiGold app offers 100% safety and security for your transactions. Each successful transaction is acknowledged via email and SMS, and all transaction details are stored digitally in the app for easy access. Additionally, the company guarantees that your gold savings are safe and secure, backed by its long-standing reputation in the jewelry industry.

How to ensure my transactions or payments are done:

|

| Payment Acknowledgement Email |

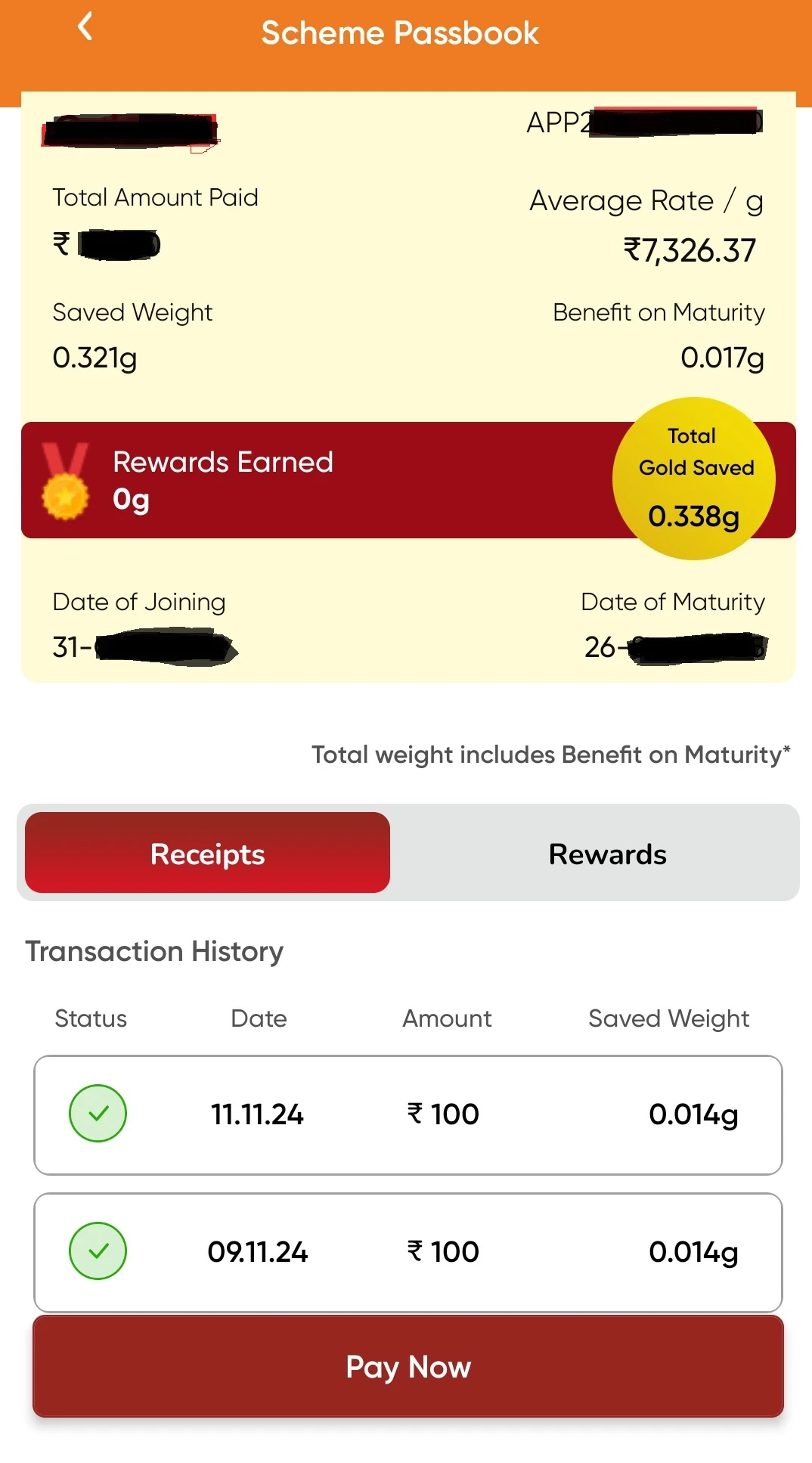

How to ensure the benefits are added:

|

| Purchase Page |

|

| Scheme PassBook |

What are the tax compliance for the savings:

Is it possible to get delivery at home in case a store purchase or a nearby store is not available:

Is it possible for the people to join this scheme from outside Tamilnadu:

How DIGIGOLD is better than other three schemes:

The other schemes THANGAMAGAL, SUPERGOLD and FUTUREPLUS offer the benefit of a 75% discount on VAT, such as making and wastage charges. However, customers will need to pay GST during the redemption.

These schemes also allow customers to save weight equivalent to 22KT gold on the day of the installment. The drawback is that customers are required to pay the same installment amount for 11 months on a fixed date. This reduces the flexibility to purchase when needed and offers limited potential for averaging the gold price.

Conclusion: Is the DigiGold Scheme Right for You?

If you’re looking for a flexible, secure, and accessible way to save gold ornaments for the future, the ThangaMayil DigiGold Savings App offers a smart solution. The scheme allows you to invest in gold digitally with minimal effort and provides benefits in terms of price averaging and additional rewards over time. However, like any investment, it's essential to weigh the pros and cons before committing.

For those who are looking to secure their financial future with a reliable and time-tested commodity, gold remains one of the best options. With the flexibility offered by the DIGIGOLD scheme, you can start small and gradually build your gold savings, making it a perfect choice for people of all ages and income levels.

Remember: Always read the terms and conditions carefully and consult with a financial advisor to ensure that this investment aligns with your overall financial goals.

Happy Investing!

0 Comments